The OCR Problem Costing Businesses Billions

By Sandra Vu

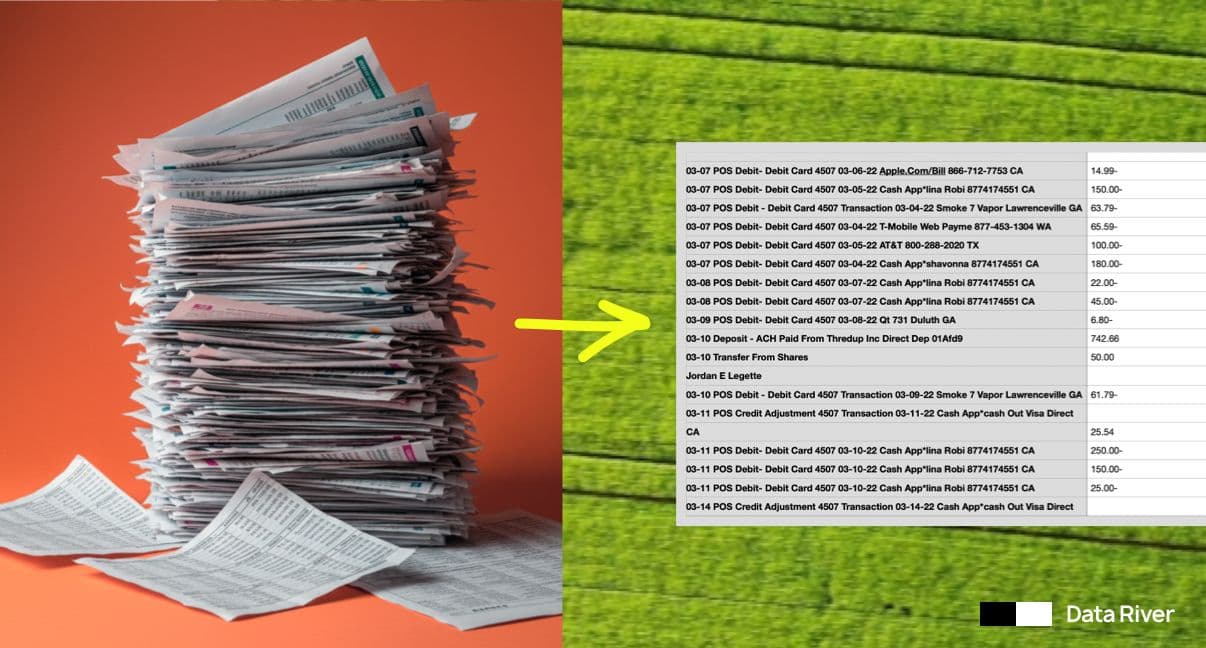

By the end of 2025, over 1.2 trillion document pages will be scanned globally. Yet most organizations and professionals still struggle with the same fundamental challenge: turning those scans into usable data.

Why Current OCR Fails Your Team

When we tested leading LLM-based OCR systems, we encountered the same problems repeatedly: hallucinated text, unstable outputs, and corrupted document structure. This creates real pain:

For Accountants & Bookkeepers: Hallucinated figures force endless manual verification. Unstable outputs mean you can't trust extracted amounts, account codes, or line items without rework. You're left spending hours on reconciliation instead of analysis.

For Private Equity Staff: During due diligence, jumbled contract terms create false signals—missing real risks or flagging problems that don't exist. Post-acquisition, unreliable OCR breaks data integration, leaving you with inconsistent financial records across portfolio companies and compressed deal timelines.

The result: automation becomes a burden, not a solution.

Introducing Data River

We built Data River to solve this problem with a different approach: OCR designed for precision, not generation.

What makes our approach different:

- High accuracy on financial documents—optimized specifically for bank statements, invoices, and contracts

- Preserves data structure and formatting throughout the extraction process

- Fast processing speed suitable for high-volume conversions

- Deterministic extraction—only captures what actually exists in the source document

- Built with enterprise-grade privacy principles. Secure by default. We train on our own data — never on client data.

One financial services client reduced document processing time by 70% while eliminating manual verification steps entirely.

Why CPU-Only Matters

Unlike LLM-based systems that demand specialized hardware and massive energy consumption (comparable to Ireland's entire electricity usage annually), Statement Flow runs on standard computers. This means:

- No infrastructure investment needed

- 80% lower energy consumption than GPU-based alternatives

- Immediate deployment without IT complexity

- Smaller carbon footprint aligned with enterprise sustainability goals

How We Built It

Our technology strips away unnecessary complexity. We use lightweight recognition models, intelligent batch processing, and smart normalization for handwriting and unusual fonts. The result is fast, reliable document scanning that requires no specialized expertise to deploy.

We're currently applying for a patent on this proprietary approach.

Get Started Today

Data River is production-ready. Organizations can begin digitizing documents with near-perfect accuracy and minimal operational overhead.

Use it now.

Data River was built by former Google Research Scientists who spent years solving document intelligence at scale. We're dedicated to making enterprise-grade OCR accessible, accurate, and efficient.

About Sandra Vu

Sandra Vu is the founder of Data River and a financial software engineer with experience building document processing systems for accounting platforms. After spending years helping accountants and bookkeepers at enterprise fintech companies, she built Data River to solve the recurring problem of converting bank statement PDFs to usable data—a task she saw teams struggle with monthly.

Sandra's background in financial software engineering gives her deep insight into how bank statements are structured, why they're difficult to parse programmatically, and what accuracy really means for financial reconciliation. She's particularly focused on the unique challenges of processing statements from different banks, each with their own formatting quirks and layouts.

At Data River, Sandra leads the technical development of AI-powered document processing specifically optimized for financial documents. Her experience spans building parsers for thousands of bank formats, working directly with accounting teams to understand their workflows, and designing systems that prioritize accuracy and data security in financial automation.